Can sustainable finance be an answer to climate change?

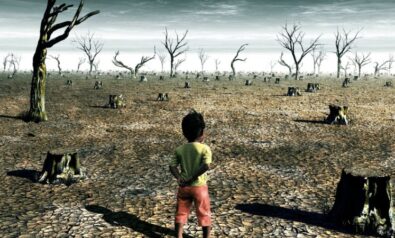

While attending the Financial Inquiry India report launch in May, Nick Robins, co-director of the United Nations Environment Programme’s (UNEP) financial inquiry team, brought up the need to address the issue of climate change in relation to the global financial system. This raised questions about how our carbon-intensive economies were not built with the intention of tackling the hurdles that climate change throws at us. It is in this “survival of the fittest” moment that people and economies must either adapt or perish in a changing climate.

Ever since we agreed climate change was a global threat, the need of the hour has been to address this “tragedy of the horizons” using a financial tool that can do so effectively and in time. While the world agrees that carbon emissions are causing irreparable damage to our planet, the need for an incentivized solution is imminent.

The solution is providing attractively priced financial alternatives that can allow people to invest in their future without feeling like they are losing a buck. Keeping this in mind, the green champions of the financial community have come out with an innovative tool that can finally change the way we do business in our globalized economy. Known as a green bond, it has been developed to swiftly address climate change concerns with the most stable way of financing solutions.

Climate Finance

Studies have shown that while climate change will affect everyone, the poorest and least developed countries will suffer the most. In order to address this grave injustice, the world’s developed nations have agreed to mobilize $100 billion a year by 2020 from public and private sources to help developing countries adapt to the impacts of climate change as well as reduce their emissions.

A report by the Climate Policy Initiative shows that out of the estimated $331 billion climate finance allocations in 2013, only $34 billion was transferred by developed countries to developing nations for adaptation and mitigation, leaving an annual gap of about $70 billion. Closing this gap is an important step if the world is going to work toward reducing emissions as outlined by the Paris Agreement in a timely manner.

Additionally, even governments in developed countries are not immune to the handicaps of budgetary constraints, and at times look to the private sector to provide capital to finance public projects. One can say that the private sector, in both developing and developed countries, plays a pivotal role in not only financing this transition, but also changing the social realities of the issue of climate change.

Moral Returns

Ever since the time of the Industrial Revolution, bonds have been the preferred choice of instrument for public and private sectors to fund large-scale and long-term infrastructure projects that need upfront capital. Similarly, a green bond puts a new spin on the concept of a traditional bond. It looks to provide stable and long-term capital, but with the same financial (matching interest rates shown by traditional bonds) and added social and environmental (and moral) returns for investors.

Green bonds provide countries and investors with the ability to invest into a capital-intensive project that is specifically targeted toward green or climate change adaption. They can also be issued by both public and private sector issuers like banks, ranging from the World Bank to private sector ones like India’s Yes Bank, institutional investors such as pension funds or insurance companies, municipalities like Washington, DC or the city of Gothenburg, universities and corporations—Unilever, Toyota and Apple are some of the big ones. It is important to have the involvement of a wide range of public and private sector actors because infrastructure is a common need that spans across various sectors and countries.

In order to have global low-carbon climate change resilient (LCR) transitions, our most important and immediate financing gap lies in our infrastructure needs. Climate change presents challenges to the already-existing and future infrastructure of both developed and developing countries. Advanced economies like the United States, Canada and other Organisation for Economic Co-operation and Development (OECD) nations have massive infrastructure upgrade needs. On the other hand, emerging economies like India and China, as well as other developing countries, face the need to build extensive infrastructure, often from scratch, that can cater to the needs of almost 85% of the world’s population.

Notwithstanding the urgent need to build LCR infrastructure, funding for regular or non-LCR infrastructure projects falls short of an estimated $1 trillion every year. In addition, only 7-13% of the current infrastructure projects are thought to be low-carbon and designed to deal with climate change impacts. It is now a well-known fact that extreme weather events are only going to become more frequent. The question is whether the world is prepared to tackle dangerous cataclysms like Hurricane Matthew, droughts like those in Syria or raging forest fires like those destroying Fort McMurray.

With climate change looming large, a city or region’s infrastructure has to withstand frequent and extreme weather on a long-term basis. This will not be possible without our ability to factor in climate change in the process of planning, funding, building and upgrading the infrastructure around us. Green bonds that fund infrastructure designed to withstand Category 5 hurricanes or establish low-carbon transportation systems will be instrumental in locking-in greenhouse gas (GHG) emissions for several decades to come.

Fair Observer provides you deep and diverse insights for free. Remember that we still have to pay for servers, website maintenance and much more. So, donate now to keep us free, fair and independent.

Fair Observer provides you deep and diverse insights for free. Remember that we still have to pay for servers, website maintenance and much more. So, donate now to keep us free, fair and independent.

As developed countries face their own needs, the resources set aside for developmental or financial aid can often be eclipsed by problems such as a lack of political support, domestic lobbying groups and economic constraints. To add to this, socioeconomic problems affecting the developed world, such as immigration fears, environmental refugees and the threat of terrorism, have added pressure on politicians to reduce channeling taxpayer money into foreign projects. In the face of these growing problems and constraints, each country needs to tap into its private sector for climate capital that will help close this gap.

Our Inner Green Investor

More recently, climate change resilience has become a buzzword in the investment community and has started creating a trend of socially responsible investment from mainstream finance, such as pension funds and other institutional investors. Green bonds provide these investors with an opportunity to be responsible and socially conscious in directing their capital into projects that have solid financial returns.

On the other hand, climate change is a global and transnational issue; there is no excludability or competitiveness in this problem. And while the private sector can hold the purse to the solution, the regulation and overseeing has to be done by the public sector. This is important because the initial accountability and legitimacy provided by governments or other public actors will be a critical factor in transitioning our carbon-based economy to a green one.

The public sector, consisting of governments or multinational development actors like the World Bank, bring in a sense of authority and long-term vision that a private company or investor does not provide. Imagine if you were to choose between a private or a government-backed bond: You would most likely choose the latter, as it has been known to provide a sense of security and stability in its investment. Similarly, if a green bond has government backing or guarantees, it would definitely be the main choice for people who are looking to invest their hard-earned pension money into it.

Bonds offer long-term maturities that make it a predictable investment, making it an attractive investment opportunity for many of us who are risk-averse. However, there is oversubscription in the current green bond market, meaning that demand significantly exceeds supply. Oversubscription shows that there is big appetite from investors but not enough projects to sustain it. Here is where private and public actors can work together to grow a small market into something that can eventually transform our economy into the sustainably developed financial system that we wish it to be.

Given that the world is already at the verge of crossing the 1.5 degrees Celsius threshold this year, it becomes paramount to transforming global economies to accommodate climate change and its significant impacts. Green bonds provide a vehicle to do this, however, the urgency in nudging our inner green investors is important to keep from crossing that dangerous 2 degrees-Celsius threshold.

It is in such changing times that we need to ask ourselves: Can investing in green bonds be a responsible investment into our future? The answer is yes.

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Photo Credit: Polina Shuvaeva

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.