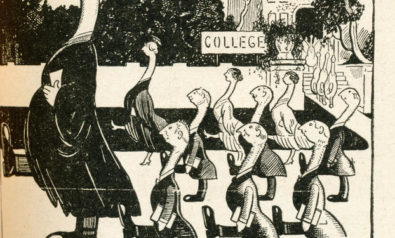

American higher education has shifted from a means to a financially secure future to a seemingly endless cycle of debt and unemployment.

Background

Higher education in the United States has always been the means to a stable, white-collar job; it is considered the path to the American Dream. Prior to World War II, college was seen as a privilege of the rich. But with the passing of the Servicemen’s Readjustment Act of 1944 (better known as the GI Bill), college was finally promoted as a viable option for soldiers, many of whom came from middle and lower-class families that could not normally afford continued education. In 1947, 49% of all new college admits were veterans. Community colleges and low-cost universities were established, such as the California Community College System and the California State University, both of which catered to low-income students. With the increase of options for more Americans seeking higher education, the economy of the 1950s flourished with the influx of educated workers able to fill the growing need for highly skilled positions.

Over the past few decades, higher education has become a source of political contention as state governments have used tuition and fee hikes as a way to increase revenues without proper tax increases. Budget cuts hit higher education quite hard as a result of the 2008 recession. Tuition costs throughout the US began to rise while services and courses were cut to save additional funds. Not only are students dealing with increased costs, but many students have been forced to take an additional few terms in order to graduate due to limited course offerings.

Upon graduation the job market has been bare. Graduates face an unemployment that, when coupled with the payments due on the loans, has created a system of underemployment. Years of study and thousands of dollars of debt have led the modern American graduates to low-level careers with little future of advancement, perpetuating the system of debt.

Why is this relevant?

Understanding the negative reality facing American college students upon graduation is imperative to resolving the economic troubles facing not only the United States but also the global economy. The recession of 2008 crippled the economy while placing a massive strain on the government. Despite recent growth, economies around the world are still struggling, with a constant fear of bankruptcies and a return to the even bleaker days of the recession. For the American college graduate such a dark perspective is derived not from fear but from a harsh reality of unemployment and debt.

In June 2010 total outstanding student loan debt exceeded total outstanding credit card debt for the first time. The US economy is stifled by over $1 trillion in outstanding student loan debt, combined with an additional $803 billion in credit card debt, which has crippled the spending power of the American consumer. Furthermore, since 1976, bankruptcy for the most downtrodden has no longer been a means of escaping debt, which furthers a cycle of fiscal repression for those that are seeking to better their own financial futures. Through the high-rate of unemployment among college graduates, the little hope that Americans leaving higher education have of freeing themselves from such a debt is looking worse with each fiscal quarter.

If the United States has any hope of remaining the dominant economic power, it needs to reinvigorate the economy through more daring schemes than are currently being utilized. As a consumer-driven economic state, it is essential that the US find a way to relieve the burden of student loan debt while improving the job market so as to once again make the educated American a force of competition within the world.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs on subjects ranging from digital media and journalism to writing and critical thinking. This doesn’t come cheap. Servers, editors, trainers and web developers cost money.

Please consider supporting us on a regular basis as a recurring donor or a sustaining member.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.