Shigeru Ishiba is a distinguished figure in Japanese politics, widely recognized for his expertise in defense and agricultural policy. He was a prominent contender in multiple Liberal Democratic Party (LDP) leadership races and was just elected Japan’s 102nd prime minister. His latest book, My Policies, My Destiny, offers profound insights into his political philosophy, which he defines as that of a “conservative liberal.” This label underscores Ishiba’s nuanced approach to governance — an idealism that seeks not just to solve the nation’s pressing issues, but to fundamentally elevate it and its people.

Ishiba’s idealism (or “Ishibaism”) has long placed him at odds with the late Prime Minister and LDP President Shinzo Abe, whose vision for Japan centered on bolstering national power and economic dominance. By contrast, Ishiba advocates “purer” solutions that aim for deeper structural improvements. This divergence is central to his critique of “Abe politics,” which he sees as prioritizing short-term gains over long-term national rejuvenation.

Ishiba and incumbent Prime Minister Fumio Kishida are committed to refocusing Japan’s growth strategies on rural regions, which have been disproportionately affected by economic disparities. While Ishiba is inclined towards fiscal discipline, he is unlikely to pursue immediate austerity measures; rather, he will probably consider carefully timed tax increases to finance rising defense expenditures.

Ishiba’s policies to manage economic turmoil

In March 2024, the Bank of Japan (BOJ) raised interest rates for the first time in 17 years. This signals an end to its negative interest rate policy in response to persistent inflationary pressures. In July, the yen dropped to its lowest value in 38 years; a second rate hike followed. Political pressure had been building for such hikes to address the yen’s devaluation.

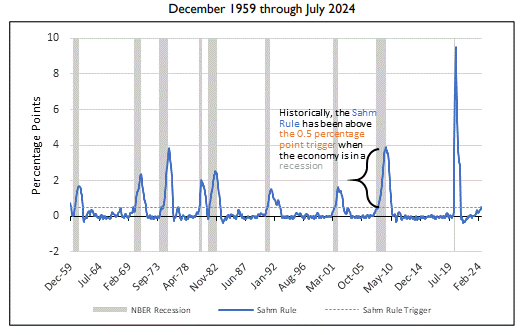

By early August, Japan’s stock market experienced a historic decline. It was partly triggered by concerns over the BOJ’s hawkish stance — a stance advocating immediate, vigorous action — and a hard slowdown in the US economy predicted by the Sahm Rule. Yet a soft landing was also predicted, as the US economy is currently strong. The decline caused political sentiment in Nagatachō — the district in Tokyo where the prime minister resides — to shift.

The Salm Rule observes the unemployment rate over the past 12 months to identify economic struggle; if the rate increases by half a percent or more in a three-month period, the rule is triggered. This usually happens at the start of a recession. Via Federal Reserve Bank of St. Louis.

Ishiba is expected to uphold the principle of central bank independence, a cornerstone of sound monetary policy as exemplified by institutions like the US Federal Reserve (or the Fed). By maintaining the BOJ’s autonomy, economists evaluate that Ishiba will allow Governor Kazuo Ueda the space needed to pursue further rate normalization, which will enhance Japan’s economic stability.

Ishiba emphasized that the government is in no position to direct monetary policy. However, he expressed his expectations that Japan’s economy will continue to progress sustainably under the BOJ’s accommodative stance, ultimately eradicating deflation. He underscored the importance of maintaining close collaboration with the central bank to observe market trends calmly and cautiously, while engaging in careful communication with market participants.

Prior to the prime minister’s remarks, Ueda indicated that the BOJ is strongly supporting Japan’s economy through its highly accommodative monetary policy. Future adjustments to monetary easing are contingent on economic and inflationary developments aligning with BOJ projections. Regardless, Ueda noted that there is ample time to evaluate these conditions, and the BOJ will proceed carefully.

Ueda further clarified that there were no specific requests made by the prime minister regarding monetary policy. Additionally, the joint 2013 accord between the government and the BOJ, prioritizing the early elimination of deflation and sustainable economic growth, was not part of their discussion.

Takaichi’s opposition to monetary tightening

Ishiba plans to appoint former Chief Cabinet Secretary Katsunobu Kato as Minister of Finance. Kato, who is a former member of the Ministry of Finance, was first elected to the House of Representatives in the 2003 general election. He served as Deputy Chief Cabinet Secretary during the Abe administration and championed the continuation of Abe’s economic policy, “Abenomics,” during the party presidential election. As always, this is the mysterious LDP way of saying, “inadequate knowledge and strategies can lead to harm.”

Sanae Takaichi, another strong conservative-leadership contender from the House of Representatives, is a staunch advocate of continued monetary easing. She has publicly opposed the BOJ’s rate hikes. During a recent online discussion, she argued that tightening monetary policy at this juncture would be premature, calling it “foolish.” Takaichi’s stance has raised fears about potential political interference in the central bank’s operations, reminiscent of certain US political figures like former President Donald Trump, who seeks to exert control over the Fed.

Meanwhile, some observers worry about having a repeat of the United Kingdom’s experience in 2022: The government of then-UK Prime Minister Liz Truss employed aggressive fiscal expansion which, compounded by concurrent rate hikes by the Bank of England, led to sharp currency depreciation and a surge in interest rates. Observers caution Japan to avoid a similar scenario, where ill-considered political statements trigger a destabilizing “Truss shock.” Indeed, Takaichi’s remarks have already contributed to volatility in the foreign exchange market, causing fluctuations in the US dollar/Japanese yen rate.

The yen depreciated from 143,000 to 146,000 following Takaichi’s rally, reversing the earlier appreciation from 146,000 to 142,000 that occurred after Ishiba’s selection. Via TradingView

Ishiba envisions the creation of an “Asian NATO” as essential for securing robust regional deterrence, with serious consideration of nuclear sharing with the US. He also desires a revision of the US–Japan Status of Forces Agreement, addressing concerns related to jurisdiction, environmental protection and the balance of legal authority between both nations over military activities and personnel.

In line with this strategic vision, it appears that he is willing to prioritize short-term economic gains over central bank independence. This signals a potential shift in his economic approach moving forward.

[Lee Thompson-Kolar edited this piece.]

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 3,000+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.

Comment