Malaysia has once again elected Mahathir Mohamad as prime minister, and the economy is topic of the day.

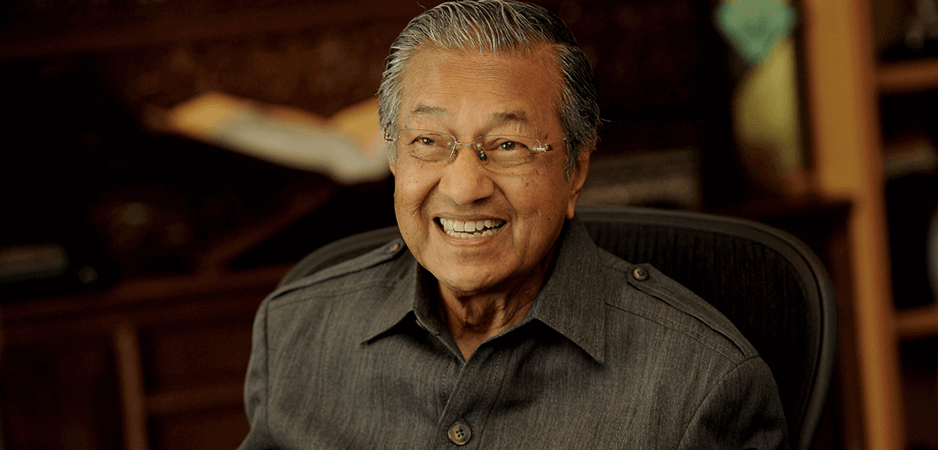

The appointment of 92-year-old Mahathir Mohamad as the prime minister of Malaysia was phenomenal in its own right, but more so in the context of the hope and expectations Malaysians have for him to rework the economy.

The general election held on May 9 was a turning point in Malaysia’s 60-year history. For the first time the ruling coalition, Barisan Nasional (BN), failed to win and form the federal government. This is a truly remarkable and extraordinary success for a myriad of reasons as the Pakatan Harapan — the coalition that Mahathir leads — victory was against all odds, including allegations of electoral fraud, a well-oiled and well-funded incumbent election machinery, and an opponent largely in control of the traditional media.

Despite some last minute delaying tactics by the previous administration led by before Mahathir was sworn in as the seventh prime minister, the transition of power has been peaceful and in accordance with the rule of law. This is a testimony to the world that even in a flawed democracy, the ability to change government without violence is possible. Lee Kuan Yew, the first prime minister of Singapore, in responding to a question on the attraction of democracy, said, “The greatest attraction of democracy is you can change government without violence.”

The differing views on current economic performance

The Merdeka Center, an opinion research firm in Malaysia, shows a consistent trend that from the end of 2013, the primary concerns for most voters in Malaysia were related to the economy, in particular, the rising cost of living. This graph plots the gross national income (GNI) per capita in US dollars and corresponds with difficult periods faced by the Malaysian economy. The most recent period shows contracting GNI per capita in dollars, which is an issue the new government must resolve.

While GNI per capita in dollars is a more appropriate benchmark for cost of living and the wealth of the populace, the outgoing government, in defending its management of the economy, pointed to high GDP growth as normally measured in the domestic currency, low inflation, low unemployment, improved Gini coefficient and reduced government deficit. However, observers and financial commentators point to the weak demand in the retail sector, serious cost of living issues despite the ostensibly low inflation rate, increasing youth unemployment, and greater disparity between the rich and poor.

Whilst there have been programs such as the One Malaysia People Assistance Program (BR1M) to help the poor through the distribution of direct cash from the government, the middle class faced increasing costs arising from the dual effects of the imposition of goods and services tax (GST) and a depreciating ringgit. Critics of former Prime Minister Najib Razak also pointed to the high levels of government debt, not to mention the contingent and off-balance sheet liabilities in the form of long-term lease payments, which are not manageable and have burdened the government finances. In addition, there are structural issues that the central bank has highlighted in its most recent report such as low wages, the plague of unemployment/underemployment faced by the younger generation, and the lack of affordable homes.

Risk to the economy

Bank Negara Malaysia, the country’s central bank, in its report for the third quarter of 2017, pointed out the potential risk of purpose-built office spaces in Malaysia. This included the most developed areas around Kuala Lumpur (Klang Valley), where the office vacancy rate is projected to reach an all-time high of 32% by 2021, which is significantly worse than that during the 1997 Asian financial crisis (AFC) of 25.3%.

Furthermore, the oil and gas sector, which is vital to the Malaysian economy, requires restructuring as well as government leadership following the crash in oil prices, which resulted in the industry facing overcapacity of oil and gas services and declining margins. This is not surprising as “quantity of money” for the industry has contracted, as can be deduced from accounts of the National Oil Corporation, PETRONAS.

Altman’s Z-score analysis of public-listed companies within the sector shows a declining trend, and several oil and gas services companies such as Jasa Merin Malaysia Sdn Bhd (a subsidiary of Marine and General Berhad), Perisai Petroleum Teknologi Bhd and Alam Maritim Resources Bhd, have announced that they are experiencing financial distress and undergoing restructuring. With the current crisis looming in the oil and gas sector, a laissez-faire approach will likely be ineffective to revive the industry. What is required in such a crisis is government intervention — i.e. expansion of the quantity of money to stimulate demand in the industry.

Pragmatic Economic Leadership

The perspective of the new government based on its election manifesto has already received criticism as a populist policy because of the promised abolishment of GST, introduction of subsidies, write down of loans for the Federal Land Development (FELDA) settlers, abolishment of toll for highways, and deferment of repayment for student loans.

Perhaps some insights can be gleaned from the events during Mahathir’s earlier tenure as prime minister between 1981 and 2003. The period prior to the mid-1980s crisis was dominated by a push toward heavy industry championed under HICOM, a Malaysian company, which included the automotive, iron and steel, plastics paper products and machinery, transport equipment and building material industries. The petrochemical sector was advanced by working with foreign partners who would provide technical knowledge, but with capital coming from the state.

In short, this was a departure from previous fiscal policy and sought to accelerate the new economic policy (NEP) — i.e. macroeconomic policy activism, such as a rebalancing the wealth in the country in favor of the majority Malay/native population.

However, commodity prices collapsed in the 1980s in response to Chairman of the US Federal Reserve Paul Volcker’s fight against inflation, which caused interest rates in America to rise significantly. As such, major Malaysian commodities such as rubber and tin suffered the same fate and, as a result, Malaysia faced a twin deficit (current account and government budget) during that period. In 1985, the Malaysian economy contracted by 1% and grew by a meager 1.2% in 1986. Furthermore, nonperforming loans (NPL) at banks rose above 30% due to a wide number of corporate failures. One of the hardest hit companies, HICOM, lost approximately $100 million. Finally, the stock market crashed due to the Pan El Crisis.

The government led by Mahathir responded with a series of adjustments, which included:

1) Contractionary fiscal policy

2) Relaxation of NEP — i.e. Investment Coordination Act, which was made only applicable to investment above $1 million and businesses with more than 75 employees. Importantly, free trade zones were created in which there was exemption from NEP policies on ownership.

3) Budget deficit reduced and managed a current account surplus

4) Introduction of the Banking and Financial Institutions Act (BAFIA), limiting exposure to foreign exchange (FX) borrowing, which allowed critical policy flexibility in 1997 during the Asian financial crisis and related party loans

5) Appointment of private sector CEOs to government-owned companies, which had mixed results, as illustrated with the winding up action against Perwaja Steel in 2017

6) Boosting foreign direct investment (from less than $500 million in 1986 to $2.3 billion post reform) and the promotion of services — e.g. tourism such as Visit Malaysia Year 1990 — and efforts to reduce current account deficit from the services sector through the use of local ports and domestic transportation.

The result foresaw a period of extraordinary growth, low unemployment (virtually full employment) and low foreign debt up until the Asian financial crisis. Extraordinarily, the government ran a surplus budget during that period.

Prime Minister Tun Dr Mahathir Mohamad on his first day at work at Prime Minister’s Office, Putrajaya. @chedetofficial pic.twitter.com/O3SzpQuTmp

— Ali Hamsa (@DrAliHamsa) May 23, 2018

Whilst the AFC of 1997 was perceived as an exchange rate crisis, in reality it was a credit crisis. The credit crisis arose because credit evaluation and validation were certainly much better, comparing the new cycle against the past — i.e. conditions preceding the Asian financial crisis as compared to the mid-80s crisis. This led to credit expansion, and the said credit expansion was possible given the inflows from foreign direct investment (FDI), offshore lending, flows into the stock market, and money creation by commercial banks. The banks could create more money as capital was increased to meet status of new capital regimes imposed by the central bank (Tier 1/ Tier 2 capitalized banks).

Noteworthy, leading economists point out that it is possible to expand credit for long periods of time, as witnessed in China, and not suffer a credit crisis if the country maintains capital controls and run a major trade surplus. In contrast to this, pre-Asian crisis, Malaysia neither enjoyed a trade surplus nor had a closed capital account.

In respect of the government surplus, there are two notable points. First, some infrastructure projects that were never commercially viable were undertaken by the private sector financed by debt. These loans inevitably became NPLs because the projects should have been public sector funded. Such projects did not have to be commercially viable as there was benefit for the public and the overall economy. However, it distorted public sector funding debt ratios, and inevitably these projects were “nationalized” once the loan turned bad.

The second important point is the widely held notion that governments worldwide should run government finances like household or corporations — i.e. they must run a surplus. This is simply not true, excluding the external sector, because if the government saves, then conversely the private sector (i.e. businesses and households) cannot also be net savers and need to borrow. Thus, the corporations were significant borrowers before the Asian crisis. Unlike households and corporations that are not able to create money, borrowing in the country’s own currency does not pose a similar threat to government as it does to households and businesses. Obviously, this does not mean governments should not be prudent in spending and managing the budget.

During the AFC and under Prime Minister Mahathir’s leadership, Malaysia had the distinction of being the only one of the four Asian crisis countries that neither sought International Monetary Fund assistance nor changed the government. Despite a sharp devaluation of the currency, the devalued ringgit quickly allowed trade deficit to turn into a surplus. To this was added the government-led restructuring of banks and large corporations. Capital controls created flexibility to reduce interest rates and spur credit expansion. The supply of money grew after the crisis from increased government spending and pent up demand for housing — i.e. mortgage lending.

Accordingly, the money supply and the country recorded growth. These issues are much better understood post the global financial crisis of 2007-08, but at the time, Malaysian government policies were thought of as unorthodox and received wide spread criticism. The policies were eventually vindicated as Malaysia’s cost from the crisis was amongst the lowest. During the AFC, the government formed the National Economic Action Council (NEAC) that oversaw the recovery and begun initiatives in areas for new economic growth in sectors such as education and health care, which have grown to be successful export earners and contributed to the trade surplus.

The Second Coming of Mahathir Mohamad

The brief economic history gives some useful insights on how Mahathir approaches issues and can allay some of the fears that analysts have regarding populist policies. The first observation is that he has a pragmatic approach to solving problems and a proven ability to adapt to changing conditions. Second, change is driven at a policy level and translated to implementation through broad measures and via government ministries and departments. This practical and effective approach to driving change at a national level has the advantage of not using expensive consultants, creating many costly new agencies and alienating civil servants.

The new government is likely to counter the loss of revenue from abolishing GST by reintroducing sales and services tax and reprioritizing its expenditure, as well as careful and tight financial management. The record claimed in the Penang and Selangor state governments could give reasons to believe that savings can be made, as the current national government has these component parties administrating the country. Although these claims have been contested by the state opposition in Selangor and Penang, there is no doubt given corruption scandals like 1Malaysia Development Board (1MDB) that there is huge potential for savings.

For those involved in transformation or change, one of the best approaches is to take radical steps. In that vein, if revenue is reduced, it will automatically force the government to cut expenses. If such radical steps are not taken, there will be continuous procrastination in removing wastage and initiating efforts to ensure the deficit does not worsen. The caricature of being minister of finance perennially handing out goodies is simply unsustainable, and the prudential management of finances will become necessary due to the reduction in revenue.

The other concern raised relates to how Malaysia manages its relationship with China. Today, China is Malaysia’s largest trading partner and major investor. Prior to the general elections, there was criticism of then-Prime Minister Najib and the mega deals he entered with China, including the estimated 55 billion ringgit ($13.8 billion) East Coast Rail (ECRL) project. Cancellation of the ECRL by the new government could provoke a negative reaction from China. In April 2018, Najib pointed out the risks of jeopardizing relations with China when he said, “If China refuses to buy important Malaysian exports such as palm oil, furniture and timber, who will buy them?”

However, Prime Minister Mahathir has reassured markets and said he would lead a business-friendly administration, and that Malaysia would seek friendly ties with other countries as a trading nation. Moreover, Malaysia’s track record during Mahathir’s tenure in the 1990s and substantial FDI gives credence to his assurances. Nonetheless, the experience in Sri Lanka with China following the change in the Sri Lankan government after the 2015 election and dealing with legacy contracts by the predecessor regime indicates there could be challenges in respect of the relationship with Beijing.

For completeness, an obvious concern would be if Mahathir returns to some of the alleged excesses of the period when he was prime minister for 22 years. This includes crony capitalism, suppression of freedom and weakening of the institutions. However, we can take comfort that the government now includes people who have stood by their principles of better governance for decades, a more vigilant population and the impact of social media. Also, at the age of 92, it is unimaginable that the prime minister would want to partake in such practices. Moreover, the opposition in the form of BN and the Malaysian Islamic Party (PAS), who have significant representation in parliament, can work as the effective opposition and provide the necessary checks and balances.

For completeness, an obvious concern would be if Mahathir returns to some of the alleged excesses of the period when he was prime minister for 22 years. This includes crony capitalism, suppression of freedom and weakening of the institutions. However, we can take comfort that the government now includes people who have stood by their principles of better governance for decades, a more vigilant population and the impact of social media. Also, at the age of 92, it is unimaginable that the prime minister would want to partake in such practices. Moreover, the opposition in the form of BN and the Malaysian Islamic Party (PAS), who have significant representation in parliament, can work as the effective opposition and provide the necessary checks and balances.

Reform

The Asian financial crisis caused a change of governments in Indonesia, Thailand and South Korea. The change of government in Malaysia may also have its roots in the AFC because that period saw the birth of the reformation movement led by politician Anwar Ibrahim. Noteworthy, the Chinese character for the word “crisis” is made up of the characters for danger and opportunity. Malaysia, as it has gone through the dangerous time without any significant violence, can now seize the opportunity. The country has been able to effect a change of government (never before achieved with its attendant risks) and now stands ready to grasp an opportunity to remake its destiny.

Many of the suggested policies in the Pakatan Harapan manifesto can improve the economy by greater competition and breaking up monopolies, which will return higher tax revenue in the longer term. Similarly, better utilization of existing infrastructure, as well as building high-quality infrastructure assets such as high-speed railway between Kuala Lumpur to Singapore, would be an impetus to economic growth. The role of the state in the economy and options for privatization could be revisited dealing with issues of crowding out and unfair competition.

While reforms may be beneficial to the economy, it can be rather difficult to implement the policies due to substantial resistance from powerful elites. Dani Rodrik, a renowned Turkish economist, pointed out in The Economics Book: Big Ideas Simply Explained that when unaccountable powerful groups of people expect to see their privilege disappear because of reform, they will use their influence to introduce economic policies that redistribute income or power to themselves. As compared to a developed nation, reforms are most effective in “intermediate countries” such as Malaysia, where hitherto the political elites were dominant enough to oppose and derail the reform movement and the benefits of reforms have yet to be fully reaped.

On public acceptance of reform, studies have found that an implemented beneficial reform that goes on to create more winners than losers is often most accepted and not repealed, even if it initially lacks popular support. In this respect, Prime Minister Mahathir has a track record of unpopular reforms — e.g. capital controls, when required during the AFC, education of mathematics and science in English, and the rolling back of NEP — but it became accepted eventually.

In Malaysia, future policies could result in growth that is sustainable, of better quality and that deal with critical risks that the economy could face. Predicting the future is difficult, but there is hope and an incredible opportunity for a much better Malaysia.

The views expressed in this article are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Photo Credit: Hussein Shaharuddin / Shutterstock.com

Support Fair Observer

We rely on your support for our independence, diversity and quality.

For more than 10 years, Fair Observer has been free, fair and independent. No billionaire owns us, no advertisers control us. We are a reader-supported nonprofit. Unlike many other publications, we keep our content free for readers regardless of where they live or whether they can afford to pay. We have no paywalls and no ads.

In the post-truth era of fake news, echo chambers and filter bubbles, we publish a plurality of perspectives from around the world. Anyone can publish with us, but everyone goes through a rigorous editorial process. So, you get fact-checked, well-reasoned content instead of noise.

We publish 2,500+ voices from 90+ countries. We also conduct education and training programs

on subjects ranging from digital media and journalism to writing and critical thinking. This

doesn’t come cheap. Servers, editors, trainers and web developers cost

money.

Please consider supporting us on a regular basis as a recurring donor or a

sustaining member.

Will you support FO’s journalism?

We rely on your support for our independence, diversity and quality.