[On December 31, 2024, we predicted seven developments for 2025 and boldly went where only fools, angels and astrologers dare to go. So, what can we expect in 2025? To borrow words from the military, a more volatile, uncertain, complex and ambiguous (VUCA) world. This is Part 5 of a seven-part series. You can read Part 1, Part 2, Part 3 and Part 4 here.]

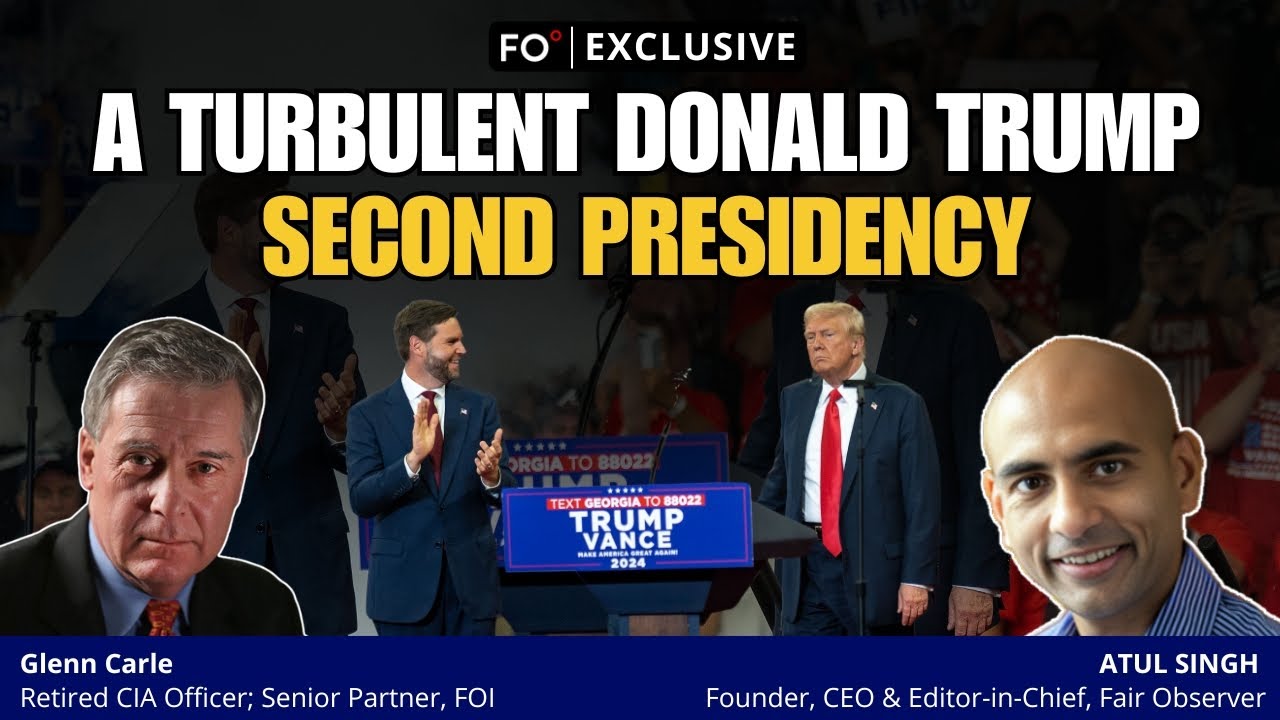

Former CIA officer Glenn Carle and Fair Observer Editor-in-Chief Atul Singh disagree on the global economy. Carle thinks the global economy will muddle through, while Singh thinks there is trouble ahead.

Global growth is promising but debt is rising

Carle takes confidence from official growth figures. The Organization for Economic Co-operation and Development (OECD) estimates global growth will be 3.3% in 2025. The US economy is projected to grow at 2.5%, the EU about 1%, China 4.8% and India 6%. These figures are relatively healthy and the global economy should be able to weather the shock of tariffs imposed by US President Donald Trump.

Singh sees record global debt — $323 billion as of December 3, 2024 — as well as protectionism and currency wars as big risks. Sovereign debt will continue to rise, increasing default risk. Both the German and French governments fell because political leaders could not agree upon a budget. Europeans will not accept cuts to their welfare states in order to save the money for Ukraine.

The dollar: a depreciating global reserve currency?

In Asia, China’s real estate bubble has burst. Rising labor costs weakened its export-led strategy, which faltered under the Covid-19 pandemic. Since 1978, China has industrialized at the cost not only of the West but also emerging economies like India and Brazil. It is betting on a new wave of industrialization in critical technologies like solar panels and batteries. State support for Chinese companies is common and well known. This is tempting many countries worldwide to raise tariffs, provoking retaliation and exacerbating inflation.

Donald Trump wants to weaken the dollar, yet simultaneously retain its status as the world’s reserve currency. He is inspired by former US President Richard Nixon’s abandonment of the gold standard in 1973 after the Vietnam War. Despite this abandonment, the dollar continued to be the global reserve currency. According to our Republican sources, there is no serious threat to the dollar given current economic crises in both China and the EU. Therefore, they are confident that the US dollar will continue to be the global reserve currency even after depreciation.

Trump’s tariffs and weakening currencies may cause turbulence

Economists at top investment banks believe that the Trump administration may also use tariffs as a tool to support depreciation, pointing to the 1985 Plaza Accord. In those Cold War days, allies with a trade surplus — France, West Germany, Japan and the UK — agreed with the US to depreciate the dollar. Our sources in the incoming Trump administration indirectly indicate that some of their colleagues are determined to bring back manufacturing to the US and see depreciation as a key policy measure.

Other countries are anticipating Trump tariffs and dollar depreciation. The Swiss National Bank, the European Central Bank and the Bank of Canada have already cut interest rates, weakening their currencies. Others are planning to follow suit. However, if all major trading countries try to weaken their currencies simultaneously, none may gain from more competitive exports, but all could experience heightened exchange rate volatility.

Change in currency value vs US dollar, January 3, 2023 – December 16, 2024. Via FOI.

Singh believes that the chances of a black swan event have increased because the structural economic and political problems are not going away. So, fasten your seatbelts and expect turbulence ahead.

[Anton Schauble and Lee Thompson-Kolar edited this piece.]

The views expressed in this article/video are the author’s own and do not necessarily reflect Fair Observer’s editorial policy.

Comment